Economics: Rich States, Poor States — Guess Where Oregon is

Podcast: Play in new window | Download

Subscribe: Apple Podcasts | Spotify | Amazon Music | TuneIn | RSS | More

Show Summary: It’s true economics isn’t the most exciting topic in the world — that is, until everything starts blowing up. Then you’ll wish you’d paid attention.

Five Different Times, on Seven Different Stations. Listen anywhere! All stations stream live!

Saturdays

10a – 11a: KFIR 720AM (entire Willamette Valley) | Direct Link to KFIR Live Stream

11a – noon: KLBM 1450AM (Union County) | Direct Link to KLBM Live Stream

11a – noon: KBKR 1490AM (Baker County) | Direct Link to SuperTalk Live Stream

7p – 8p: KWRO 630AM (Oregon Coast & Southeastern Oregon) | Direct Link to KWRO Live Stream

Sundays

8a – 9a: KWVR 1340AM (Wallowa County) | Direct Link: KWVR Live Stream

7p – 8p: KAJO 1270AM or 99.7FM (Grants Pass/Medford) | Direct Link: KAJO Live Stream

Mondays

After the show airs on our network of radio stations, you can listen to our podcast either here on our site or your favorite podcast platform. We are now on Apple podcasts, Spotify, Stitcher, TuneIn, and more. See the full podcast list.

Original Air Dates: May 15 & 16, 2021 | Jonathan Williams

This Week: Economics isn’t always exciting — unless things are blowing up. Or it’s a horse race.

We welcome back Jonathan Williams, Chief Economist and Executive Vice President of Policy of the American Legislative Exchange Council. ALEC has just released their 2021 Rich States, Poor States guide for 2021, an annual guide to the 50 states’ economic outlook. Talk about good, bad, and ugly. Look no further than how the states are competing with one another.

The Overall U.S. Economy & Economics

Before we narrow down to the states, we first look at the overall economy. This is a bit of a continuation of the last time Jonathan was on, when we talked about the democrats’ shift to what we call “non-reality economics.” The democrats’ plans are an explosion of taxes and spending sprees (what did we just say about exploding economics…?).

That discussion, was about the radical shift we’re seeing the democrats trying desperately to push on the U.S. Which, sadly, takes a hard left turn away from what has made America successful. It’s a fantasy land where debt has no meaning, money is infinite, and all we need to do is print money and borrow until every there’s a unicorn in every garage and a leprechaun in every pot.

But the problem democrats always run into is simple one. Reality. And there’s proof, thanks to the 50 test tubes of democracy that make up America.

Good Economies: How NOT to do it

Sometimes, to know what to do, it helps to know what not to do. And look no further than New York State, which had the worst response to covid and lost a congressional seat due to people fleeing the Empire State. And now new York will punish the people and businesses that for some reason haven’t left. Yet.

We talk with Jonathan about his terrific article in the National Review, “The Fallout from ‘Progressive’ Budgets in New York.” There has been a massive shift in who pays for things. Now, instead of New York being in debt to cover its debt, everyone else gets to go in debt to cover New York’s debts.

And that’s the direction we as a nation are headed. Where there is a fundamental shift in who pays for things: everyone is paying for everyone else. That’s socialism. Marxist ideology pushed onto America.

Socialism only survives as long as it is able to feed off the success of capitalism

– Mark Anderson

Rich States, Poor States

Why and how economies and economic policies work is sometimes beyond people’s wheelhouse. But everyone understands competition, right? Who’s best. Who’s worst. And who’s on the way up and who’s on the way down.

That’s where Rich States, Poor States comes in. (You can download your own copy right here.) RSPS is a look back at the states’ economic performances over the last 10 years—of available data. This year, its’ a look at 2009–2019.

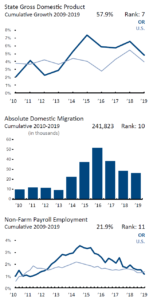

The backward-looking economic performance ranking examines how well states did. Oregon, from 2009–2019, really didn’t do too bad. This ranking looks at three variables: a state’s gross domestic product, their absolute domestic migration, and non-farm payroll.

Take a look at Oregon’s charts. And look at how well they’re correlated. As the state did better and better, culminating in 2015, people moved in (especially in 2016). Payrolls went up. And then, as Oregon’s GDP declined, there went the people. And payrolls dropped.

See? Economics isn’t too hard.

Oregon’s Economic Outlook

When it comes to Oregon’s economic outlook ranking, every year we’re like “please don’t embarrass us, please don’t embarrass us…” And then there we are. Near the bottom. Again. But it’s even worse this year.

You’ll have to tune in to hear just how bad. (Or, you could cheat and go right to Rich States Poor States to find out.) But here’s a hint. We beat even our idiot neighbor to the south in some categories. In fact, in the worst possible category. And we’re worse than New York State in some categories. You know, the one state we just mentioned. How not to run an economy.

Although at least the beat us to the bottom for the worst outlook. Hey. You gotta look for the positive right?

The I Spy Radio Show Podcast Version

Trapped under a heavy object? Missed the show? Don’t worry—catch the podcast version. I Spy Radio is now available on your favorite platform, or you can grab it right here. See the full list of podcast options.

Links Mentioned

- Jonathan’s organization is American Legislative Exchange Council, or ALEC. Be sure to check their new and improved website which now features terrific, insightful articles and videos: www.alec.org

- Rich States Poor States. You can download the latest (2021) edition, or explore previous ones.

- Jonathan’s terrific articles:

- “The Fallout from ‘Progressive’ Budgets in New York” (National Review, May 7, 2021)

- [Kansas] “The Heartland Property-Tax Rebellion” (National Review, Apr 26, 2021)

- (See also this ALEC policy discussion on the Truth in Taxation Act)

- “New Census Report: Americans Continue to Vote with Their Feet in Favor of Economic Opportunity” (ALEC, Apr 26, 2021)

- Inflation is happening, despite what lies the Biden administration is spewing. See the Consumer Price Index charts.

Did You Know…?

- The Fed has been pumping (printing) money into the economy. But something new happened in 2020. Now, they are buying corporate bonds. This is a direct investment into select corporations. Here’s a hint. It’s not mom-and-pop shops. It’s gigantic companies that don’t need the money, but the Fed is rewarding them anyway.

- The Fed says it is going to start buying individual corporate bonds (CNBC, June 15, 2020)

- The Fed begins purchases of up to $250 billion in individual corporate bonds (Markets Insider, June 15, 2020)

- Why the Fed’s new index approach to buying U.S. corporate debt ‘changes everything’ (MarketWatch, June 18, 2020)

- Fed Makes Initial Purchases in Its First Corporate Debt Buying Program (New York Times, May 12, 2020)

- Is the Federal Reserve Printing Money? (The Balance, May 11, 2021)

- Why is the Fed buying up mortgages? At $40 billion per month. Is this why the housing market keeps exploding? “Understanding the Federal Reserve Balance Sheet” (Investopedia, Mar 19, 2021)

Related Links

- The Fed Should Get Out of the Mortgage Market: Even central bankers are starting to wonder why they’re adding $40 billion of housing debt every month. (Bloomberg Opinion, May 11, 2021)

- “Why exactly is the Fed still increasing its holdings of mortgage-backed securities by $40 billion a month when Chair Jerome Powell himself has said that “the housing sector has more than fully recovered from the downturn”?* “The Fed has gobbled up almost $2 trillion of MBS since March 2020, which is more than its total aggregate purchases in any of its previous quantitative easing episodes.”

- At an average home mortgage price of $250,000, the fed backs the mortgage on some 8 million homes. Yikes!

- In 2010, The Fed answers FAQs on Mortgage Backed Securities

- What Is An Agency MBS And How Does The Federal Reserve’s Purchase Of MBS Affect Mortgage Rates? (Quicken Loans, Feb 19, 2021)

- “A mortgage-backed security (MBS) is a pool of home loans, often packaged by Fannie Mae, Freddie Mac or Ginnie Mae, sold on the open bond market to investors. The investors who buy the securities then receive the payback on a monthly basis when homeowners make their principal and interest payments.”

- Difference Between Agency and Non-Agency Mortgage-Backed Securities (The Balance, Jul 15 2020) – “Agency” simply means an dept of the federal govt, or MBS that become backed by the full faith and credit of the U.S.